CHRO Trends 2021 Report

By Zac Upchurch, Chief Operating Officer, Talent Strategy Group

Welcome to the fourth edition of our Chief Human Resources Officer report that reviews trends in the Chief Human Resources Officer and Chief People Officer marketplace and introduces the Fortune 200 new CHROs who came into the role in 2020.

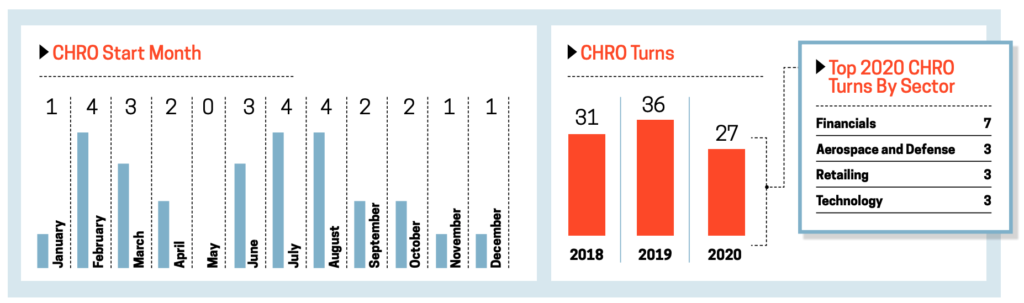

The Fortune 200 welcomed 27 new Chief Human Resources Officers in 2020, a turnover of nearly 15%. These new CHROs represent more than 5 million employees and oversee more than $1.6 trillion in annual revenue.

This new CHRO class continue many trends identified in previous reports such as a further increase in female representation, a continued strong correlation between CEO and CHRO turnover, and the trend of organizations selecting outsider CHROs to fill their top Human Resources role. However, 2020 was also a year of immense change as companies grappled with a global pandemic and within the United States social and racial justice campaigns. Responding to these macro events, companies ushered in new ways of working, more frequent communication and transparency to employees, and increased focus and accountability to deliver superior business results through a diverse and inclusive culture. More than ever, the CHRO role was elevated as one critical to company value creation.

Much like the broader environment, the trends in the CHRO marketplace also experienced change. Our analysis of the Fortune 200 new CHROs illustrates 7 key trends in the CHRO marketplace with impacts to current and aspiring CHROs.

I wish to thank the report contributors and I look forward to working with the new Chief Human Resources Officers and Chief People Officers to advance the field of Human Resources in 2021 and beyond.

Trend #1: CHRO Turnover Declines

2020 represented the lowest overall turnover in the Chief Human Resources Officer role since this report’s inception and a 25% reduction in turnover from 2019. 27 new Chief Human Resources Officers came into the role of a Fortune 200 organization in 2020, representing a nearly 15% turnover rate and implying that organizations replace their CHRO every 6.67 years (1). Turnover within the Fortune 200 was roughly evenly distributed by the organization’s fortune ranking. The Fortune 50 saw seven new CHROs, Fortune 51-100 saw six new CHROs, Fortune 101-150 saw seven new CHROs, and the Fortune 151-200 saw seven new CHROs in 2020.

The Financials sector held the highest absolute number of new CHROs with seven CHRO changes (out of 36 organizations in the Financial sector within the Fortune 200). Hotels, Restaurants, and Leisure (67%), Aerospace & Defense (50%), and Household Products (50%) represented the highest sector-specific percentage of CHRO turns. The most frequent starting months for a Fortune 200 new CHRO were February, July, and August with four new CHROs in each month. The global pandemic did not appear to significantly impact the starting month for new CHROs. When compared to the previous three CHRO Trend reports, the starting month for CHROs remained mostly constant, though total volume of starts declined in 2020 consistent with the lower number of Fortune 200 new CHROs.

The average predecessor CHRO tenure for the Fortune 200 new CHROs was 4.9 years, a significantly lower tenure than the 6.67 year tenure for sitting Fortune 200 CHROs. The longest tenured predecessor CHRO was Michael D’Ambrose from Archer Daniels Midland, now CHRO at Boeing. The shortest tenured predecessor CHRO was Darcy Mackay from CBRE, now Group President at CBRE.

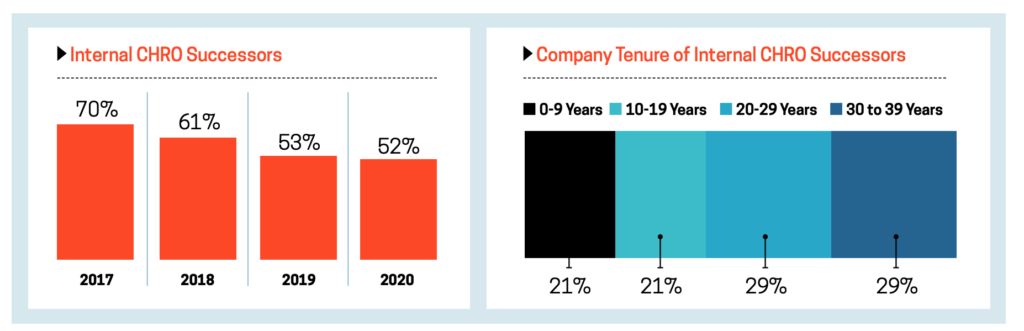

Trend #2: Internal Succession Stabilizes

Since 2017, there’s been a consistent, declining trendline for internal CHRO session. In 2017, 70% of CHROs were internal successors compared to 61% in 2018 and 53% in 2019. 2020 saw a stabilization of internal CHRO succession where 14 (52%) of the Fortune 200 new CHROs were internal CHRO successors.

Internal successors had an average organization tenure of over 20 years prior to CHRO appointment. 11 (79%) of the Fortune 200 new CHROs had at least 15 years of tenure in the company prior to being appointed CHRO. The remaining 3 (21%) new CHROs had five or fewer years of tenure in the organization prior to CHRO appointment.

Aspiring first-time CHROs overwhelmingly progress to the top HR role through internal succession. 100% of internal successors were first-time CHROs and internal successors represented 88% of first-time CHROs in 2020 (2).

Trend #3: The Experienced Outsider

Organizations that go external for a CHRO successor most frequently look to bring in an experienced CHRO. In 2020, 100% of external successors of the Fortune 200 new CHROs had Human Resources domain experience and 85% of the new CHROs were previously a CHRO. This is roughly consistent with previous years where in 2019, 82% of new CHROs were previously a CHRO. 2020 examples include:

• Donna Morris joined Walmart as EVP and Chief People Officer in February 2020, having previously served as CHRO and EVP of Employee Experience at Adobe. Donna joined Adobe in 2002 and served across a number of HR domains including Talent Management, HR Operations, and Employee Experience.

• Jennifer Weber joined Archer Daniels Midland as SVP and Chief Human Resources Officer in August 2020, having previously served as EVP of HR at Lowe’s. Prior to Lowe’s, Jennifer held a CHRO role at Duke Energy and an SVP, HR role at Scripps.

• Elcio Barcelos joined U.S. Bancorp as SEVP and Chief Human Resources Officer in September 2020, having previously served as SVP, Chief People and Places Officer at Fannie Mae. Prior to Fannie Mae, Elcio held a number of Talent Acquisition and HRBP roles in companies like DXC Technology, Hewlett Packard Enterprise, Wells Fargo, and Bank of America.

Breaking with the 2019 trend, the majority (55%) of 2020 external CHRO successors moved to a smaller company than the predecessor company (3). And unlike CEOs where industry/sector experience is an important consideration to selection of an external CEO successor, there appears to be limited importance placed on industry or sector experience when selecting an external CHRO successor. Just 27% of external successors in 2020 had previous experience in the sector of their new company.

Trend #4: CEO Turnover Drives CHRO Turnover

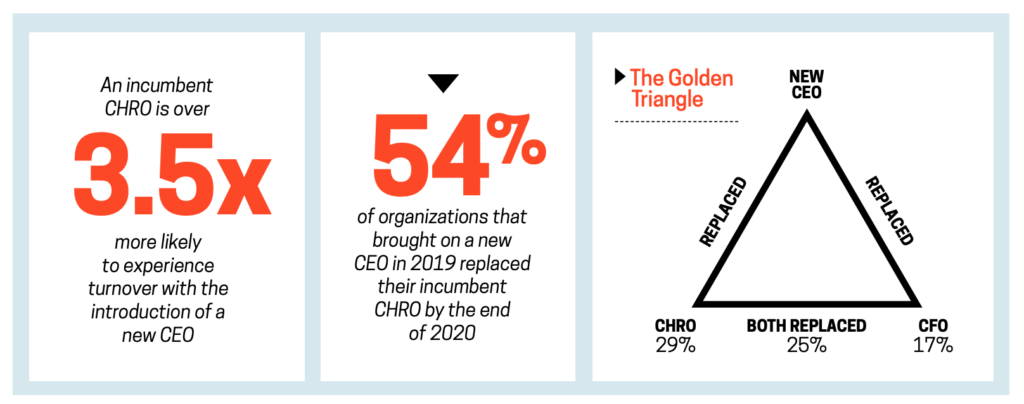

CEO turnover is a strong predictor of CHRO turnover. An incumbent CHRO is over 3.5x more likely to experience turnover with the introduction of a new CEO. The majority (54%) of organizations that brought on a new CEO in 2019 replaced their incumbent CHRO by the end of 2020. Of those replacements, 85% occurred within 12 months of the new CEO start date. In fewer cases, the new CHRO starts a few months before the new CEO as was the case for an additional 8% of organizations that brought on a new CEO.

Collectively referred to as the “Golden Triangle,” Sandy Ogg of CEO.works calls out the three most critical roles in creating value as the CEO, CHRO, and CFO roles. When these roles and its incumbents work well together, value is created. It is therefore not surprising to see a correlation of turnover across these three key roles. In just one in four organizations that brought on a new CEO in 2019 did the incumbents in the CHRO and CFO roles both remain in their roles by the end of 2020. 25% of the time, both the CHRO and CFO were replaced by the end of 2020. And in 29% of the time, just the CHRO was replaced versus in 17% of the time, just the CFO was replaced by the end of 2020.

An incumbent CHRO and CFO has increased turnover risk when the CEO successor is external as opposed to internal. 88% of 2019 external CEO successors replaced at least one incumbent of the ‘golden triangle’ while 69% of internal CEO successors replaced at least one incumbent of the ‘golden triangle’ by the end of 2020.

Trend #5: Female CHROs Dominate

The female CHRO continues to be a beacon for female representation within leadership teams. Over three-fourths (78%) of the Fortune 200 new CHROs were female. Overall, the Fortune 200 CHROs are 70% female and 30% male. This represents the largest overall female representation in the CHRO role since this report’s inception.

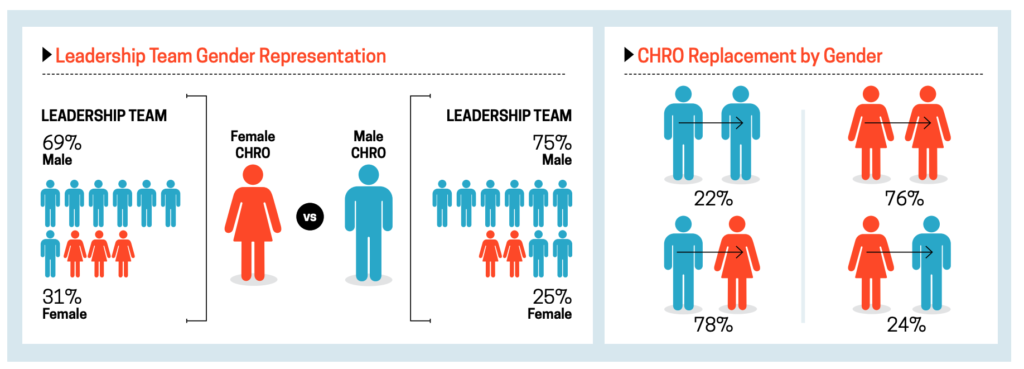

Leadership teams with a female CHRO had more balanced gender representation than leadership teams with a male CHRO. On average, the leadership teams of the Fortune 200 new CHRO companies were 70% male and 30% female (4). If the CHRO is male, the leadership team skews towards increased male representation at 75%. This is contrasted to if the CHRO is female, the leadership team has higher than average female representation at 31%.

Driving the increase in female CHRO representation is the shift of outgoing male CHROs for an incoming female CHRO. Just over half of the time (58%), an outgoing CHRO was replaced with an incoming CHRO of the same gender (male for male or female for female). An outgoing male CHRO was replaced with an incoming male CHRO 22% of the time while an outgoing female CHRO was replaced with an incoming female CHRO 76% of the time.

Trend #6: The Educated, Deep HR Leader

The Fortune 200 CHRO is educated, with depth in the Human Resources domain, and likely was appointed CHRO from a top Human Resources Business Partner role.

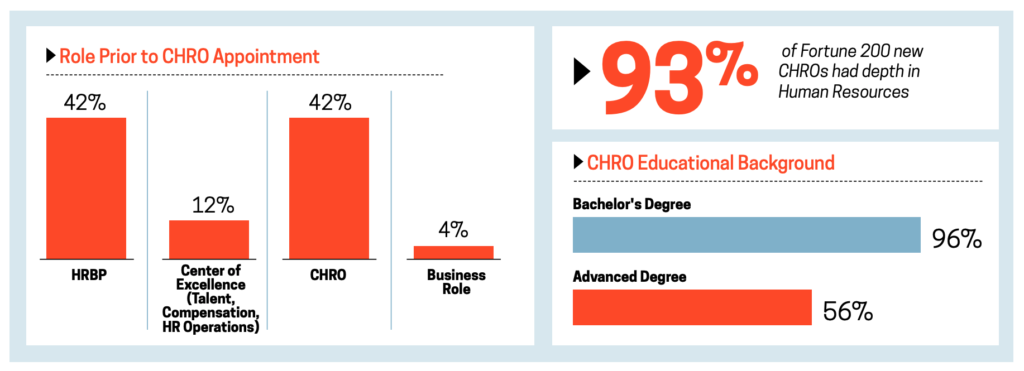

96% of the Fortune 200 new CHROs had a bachelor’s degree or equivalent and 56% held at least one graduate degree. The most common undergraduate degree for the Fortune 200 new CHROs was Psychology at 22%. This is followed by Business Administration/Management (19%) and Industrial & Labor Relations (11%). The University of Michigan graduated the most Fortune 200 new CHROs from undergrad at 7%. An MBA was the most prevalent graduate degree for the Fortune 200 new CHROs with 15% of CHROs holding an MBA. Columbia University graduated the most Fortune 200 new CHROs from graduate school at 7%.

Deep experience in Human Resources was an increased priority for CEOs selecting a new CHRO. Since this report’s inception, the percent of CHROs with limited to no experience in Human Resources prior to taking on the Chief Human Resources Officer role has been steady at ~20%. In 2020, 93% of Fortune 200 new CHROs had depth in Human Resources.

The pathway to the CHRO role runs almost exclusively through a top Human Resources Business Partner role. 42% of the Fortune 200 new CHROs were in an HRBP role prior to being tapped for the top Human Resources job. An additional 42% previously served as a Chief Human Resources Officer or Chief People Officer. Just 12% of Fortune 200 new CHROs served in a Center of Excellence (COE) immediately prior to their appointment, a mix of talent, compensation, and Human Resources operations roles.

Trend #7: The CHRO’s “Second Act”

Outright retirement is a rarity for outgoing Chief Human Resources Officers where 27% of outgoing Fortune 200 CHROs retired without plans to continue employment elsewhere. A surprising 50% of outgoing CHROs moved into a new CHRO role or equivalent, the majority of which (55%) moved to a smaller company as measured by the company’s market capitalization. An additional 16% serve on Board(s) and/or are independent consultants. 2020 examples include:

• Brent Hyder, previously Chief People Officer of Gap, Inc. (Fortune 199), joined Salesforce (Fortune 190) as the President and Chief People Officer.

• Diane Gherson, previously Chief Human Resources Officer of International Business Machines (IBM, Fortune 38) serves on two boards: SemperVirens Venture Capital, a fund that invests in workforce, healthcare, and financial technology companies, and Ping Identity. Diane additionally joined the faculty of Harvard Business School.

• Dawn Rogers, previously of Pfizer (Fortune 64) serves as Managing Director to American Securities portfolio companies on HR and organizational design.

About the Research

We produced this information by analyzing the Fortune 200 organizations (based on the 2020 Fortune 500 list) and publicly available information for Chief Executive Officers, Chief Financial Officers, and Chief Human Resources Officers. We additionally spoke with many Chief Human Resources Officers and their teams within the Fortune 200 to validate data where publicly available information was not available.

In total, 181 organizations had a sitting, identifiable CHRO at the time of this report. The trends highlight those 181 organizations of the Fortune 200. Some organizations, such as Berkshire Hathaway, do not have a sitting Chief Human Resources Officer. In those situations, we did not include the company in the analysis.

1) 19 companies in the Fortune 200 did not have a verifiable or sitting incumbent CHRO at the time of this analysis. Examples include Berkshire Hathaway and AutoNation. These 19 companies were excluded from the analysis.

2) Carmen Fernandez previously served as a CHRO for a Marsh and McLennan Companies organization, Guy Carpenter.

3) Larger in this context is defined as revenue based on 2020 figures. In 2019, 100% of external CHRO successors moved to a company that was larger than the predecessor company.

4) Based on leadership team designations displayed on company websites.

More About The Author:

- Zac Upchurch, Chief Operating Officer, Talent Strategy Group

- Zac joined the Talent Strategy Group in 2016 and now directs the daily operations of the firm, including strategy, planning, and finance, across all of TSG businesses. Zac also leads the firm’s relationships with premier clients globally and consults with select clients worldwide.