Critical Roles Report 2025

Post content

Introduction

Our 2025 Critical Roles Report brings you global insights on how companies select and manage their highest value roles.

As organizations increase their sophistication in talent management, their logical next step is to understand which roles add value, why and to ensure they derive value from those roles. Our research project asked how organizations today are identifying and managing critical roles.

We thank the more than 250 firms that responded to our first request for participation. Your enthusiasm has made it possible for us to continue providing the HR community with valuable research insights for 15 years.

Consistent with all Talent Strategy Group research, we provide these findings at no cost, we focus on the presented data with a minimum of verbiage and intently avoid the editorial bias that colors many consulting firms’ research reports.

We hope you find these insights valuable and can apply them to elevate how your organization manages its talent.

Best regards,

Marc Effron, President

Peter Attfield, APAC Representative

Executive Summary

The Scene: Question and Answer session at your Annual Shareholders meeting.

Large Investor: Ms. CEO, some management consulting firms recommend that companies identify their critical roles or engage in a talent-to-value process. Does your company do that?

CEO: Yes, we identify critical roles and we largely select roles with a disproportionate impact on strategy or value creation, or with a noticeable impact on operations, revenue or risk if left unfilled. We’ve been doing that for several years now.

Large Investor: That’s very encouraging. And they’re all part of your succession planning process?

CEO: Well, many of them.

Large Investor: But I assume you have “ready now” successors for such important roles?

CEO: Uh, we don’t consistently have that, no.

Large Investor: But, of course you have development plans for the leaders in the roles?

CEO: Not really, not yet.

Large Investor: Well then at least reassure me by saying you’ve put high performing or high potential talent in those critical roles!

CEO: Well… sometimes!

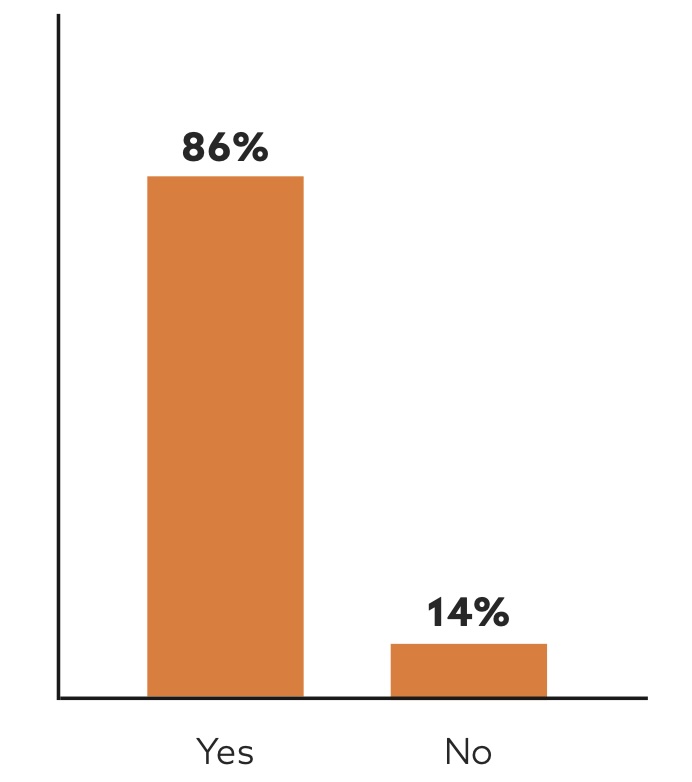

That disappointing dialogue summarizes the key findings from our inaugural Critical Roles survey. We’re encouraged to find that 86% of our global respondents identify critical roles in their company. Most of them use valid criteria to do that, avoiding common mistakes like selecting critical roles by hierarchy.

But, when asked what happens next, the process quickly falls apart. Barely half of respondents say that high performers or high potentials are in these roles. Half say there are “ready now” successors and only 25% say there is a development plan for the incumbent.

These findings beg the question of whether we are merely “ticking the box” on critical roles or truly making it matter in terms of talent practice, execution and, ultimately, business impact.

Do you identify some roles in your organization as being critical or having special value?

It’s great news that 86% of the 200+ responding companies say that they identify select roles as being critical or having special value. We found that number surprising given that the critical roles identification process often requires more executive input and sponsorship than other talent processes.

Of the 14% responding who do not identify critical roles, more than half say they plan to start this year. Their key factor in their moving forward is to identify the correct definition of a critical role.

By Company Size

There was no difference in use of critical roles by company size. This makes sense as there’s no cost or technology barrier to implementing this concept. Curiously, 98% of the 39 companies with 10,000 – 25,000 employees said they use critical roles, but we’ll consider that a statistical aberration rather than a unique finding.

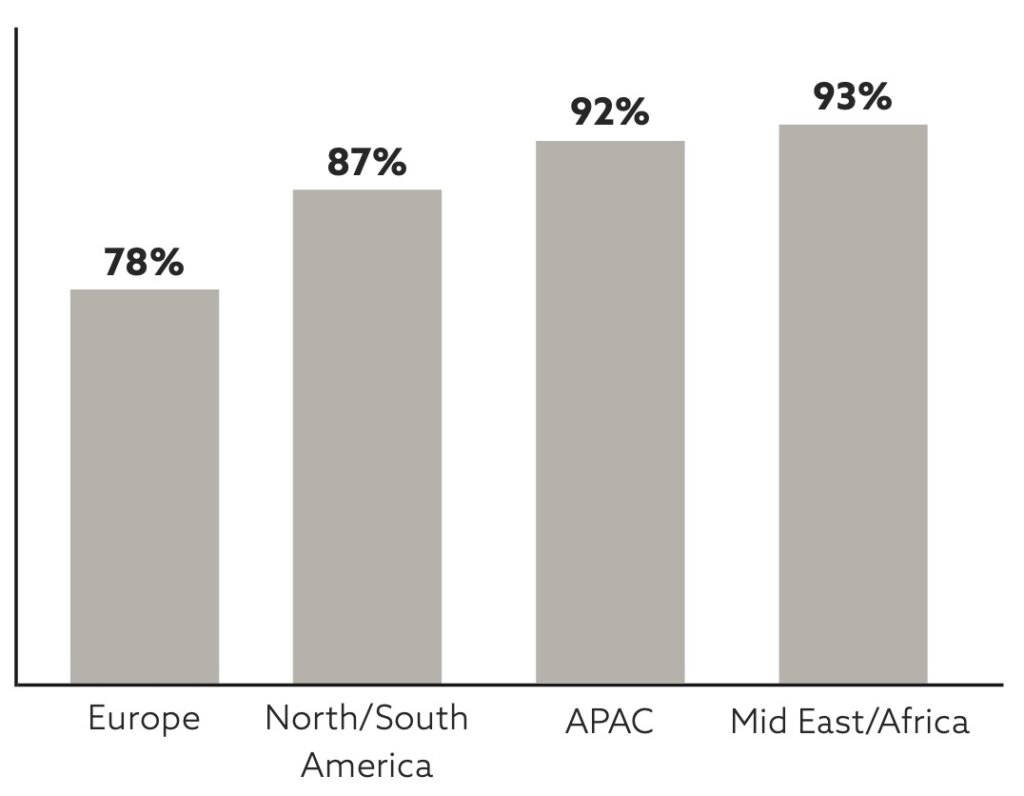

By Global Region

While every region showed strong adoption of the critical role concept, the MidEast/Africa and APAC regions were measurably above both North/South America and Europe. As we show later in this report, proper implementation is far more valuable than simply ticking the implementation box.

What is your definition of a critical role in your organization?

How a company defines a critical role matters tremendously since it influences how many leaders will be included in the categorization, the specific actions they will take to support them and much more.

About 150 respondents provided their company’s definition of a critical role. They were wide ranging and a ChatGPT 4o analysis of the list produced the following categories:

1. Strategic Impact

- Roles that are essential to achieving the company’s strategic objectives and business continuity.

- Positions that drive long-term competitive advantage and organizational growth.

- Roles that influence corporate direction, execution, and transformation.

2. Financial and Business Value Contribution

- Roles that have direct revenue-generating impact (e.g., sales, product development, investments).

- Positions that contribute significantly to cost efficiency and profitability.

- Roles that ensure operational efficiency and financial sustainability.

3. Risk and Business Continuity

- Positions whose absence would severely disrupt operations or pose a major business risk.

- Single points of failure—roles that, if vacant, create significant operational gaps.

- Succession risk—roles with no ready internal replacements or limited external availability.

4. Talent Scarcity and Specialized Expertise

- Hard-to-fill roles due to market scarcity, requiring niche skills, deep expertise, or industry knowledge.

- High barriers to entry—roles needing extensive education, training, or specialized certifications.

- Roles with unique skill sets that cannot be easily developed internally.

5. Leadership and Influence

- Executive and senior leadership roles (e.g., CEO-1, VP+, Director-level and above).

- Roles with broad span of control, high decision-making influence, or stakeholder visibility.

- Experts in critical functions that guide others or hold key institutional knowledge.

6. Competitive Advantage and Market Differentiation

- Roles that enable value creation by driving innovation, customer experience, or strategic execution.

- Positions that support scaling for growth in evolving business environments.

- Roles that maintain customer relationships, compliance, and brand reputation.

7. Impact on Core Business Processes

- Roles integral to product development, customer service, supply chain, and manufacturing.

- Positions that support essential business interdependencies and drive efficiency.

- Critical to delivering value to customers, investors, and employees.

8. Defined Critical Role Frameworks

- Some companies use grading models (e.g., WTW Grading, CEO-1, EVP-1) to define critical roles.

- Others classify short-term critical roles vs. long-term business-critical roles.

- A subset defines critical roles as the top 2-3% of positions within the organization.

What criteria do you use to define critical roles?

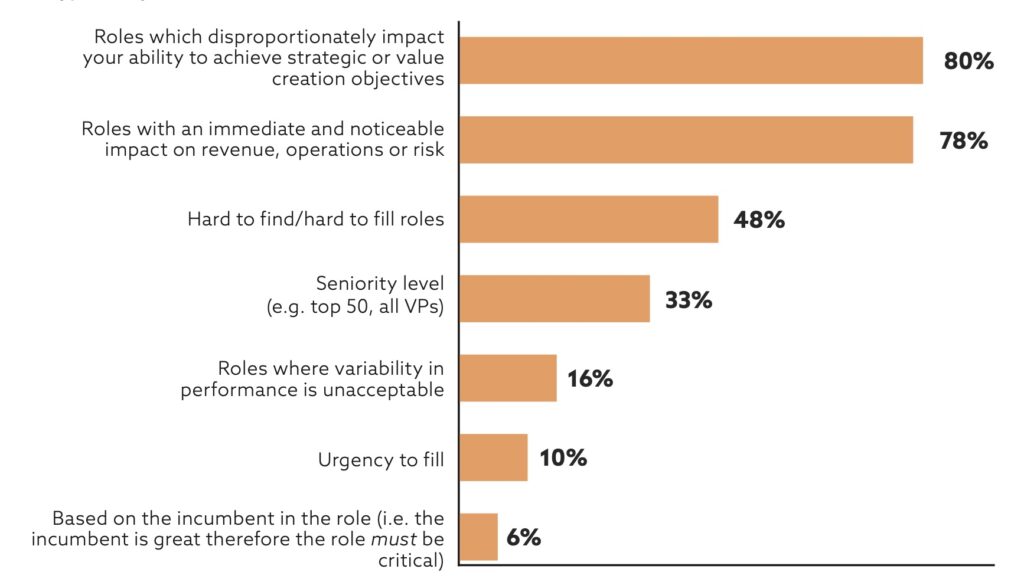

The good news is that most companies use appropriate criteria to select critical roles.

“Roles which disproportionately impact your ability to achieve strategic or value creation objectives” and “Roles with an immediate and noticeable impact on revenue, operations or risk” were used respectively by 80% and 78% of responding companies.

That doesn’t mean the right roles were selected using those criteria but the starting point for selection was correct. In our experience, the level and sophistication of strategic analysis to identify these high value impact roles often lacks the rigor (and data) to support robust conclusions being drawn.

Opportunities to improve

While many companies are doing the right thing, a substantial minority are still using the wrong selection criteria. 48% of companies consider hard to find or hard to fill roles to be critical. We consider this to be a classic mistake in classifying these roles. A hard-to-fill role might be one with temporarily high market demand. That says nothing about the role’s criticality to your business or impact on its revenue, operations or risk.

33% of companies select critical roles by seniority level. While there’s likely some overlap in executives and critical roles, this is a very lazy approach. It both includes executives who aren’t critical and misses other senior leaders who are.

Curiously, only 16% said that their critical role definition included, “Roles where variability in performance is unacceptable.” It may be that this definition is suggested in the earlier definitions. But, ideally a critical role is one where consistent high performance (hence, little variability) is required for success in the role.

What do you call these roles?

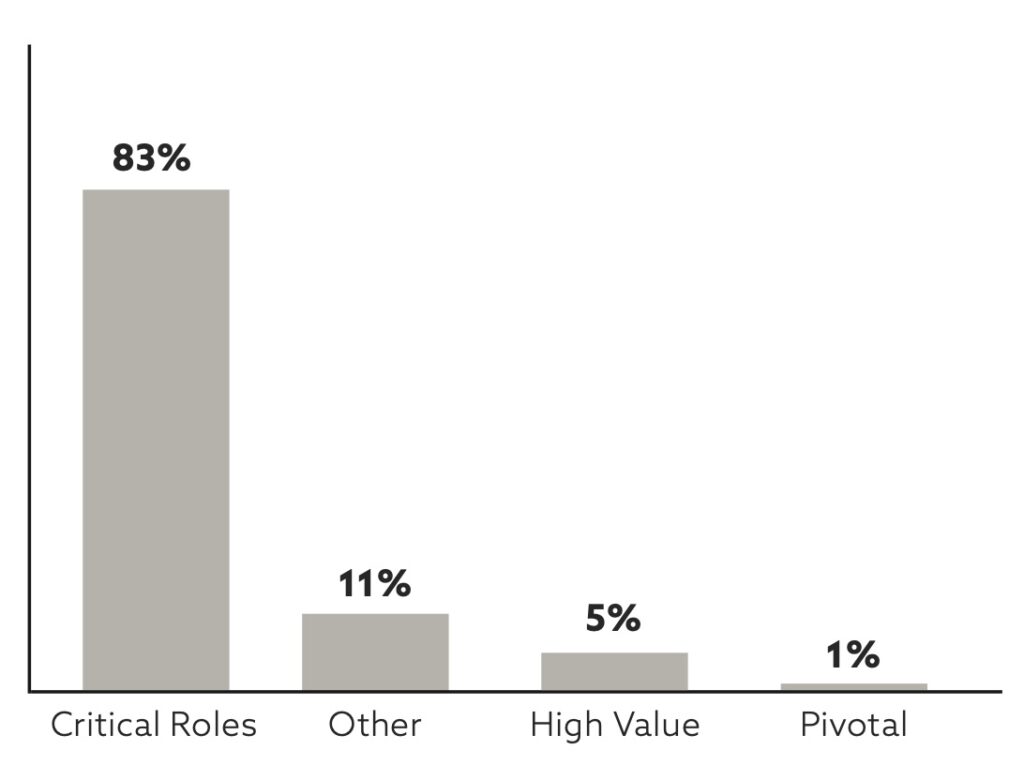

These roles of differentiated value are broadly referred to as “Critical Roles” with 83% of companies labeling them this way. Among the 11% labeling them in other ways, choices include “critical contributions,” “key positions,” “critical value roles” and “high impact.” 5% call them High Value roles and 1% call them Pivotal.

History of Critical Roles

There’s a relatively long history for identifying critical roles with 46% of companies having done this for more than 3 years. Only 21% of companies are in the first year of identifying these.

There’s a small correlation between company size and how long they’ve been using critical roles.

Identified but not activated

A classic HR problem resurfaces when we look at how companies manage critical roles.

It was gratifying to see that 86% of companies identify critical roles and that many of the remaining plan to in the near future. Most of those companies have solid criteria for what constitutes a critical role. But the Achilles heel of talent practices soon appears – follow through.

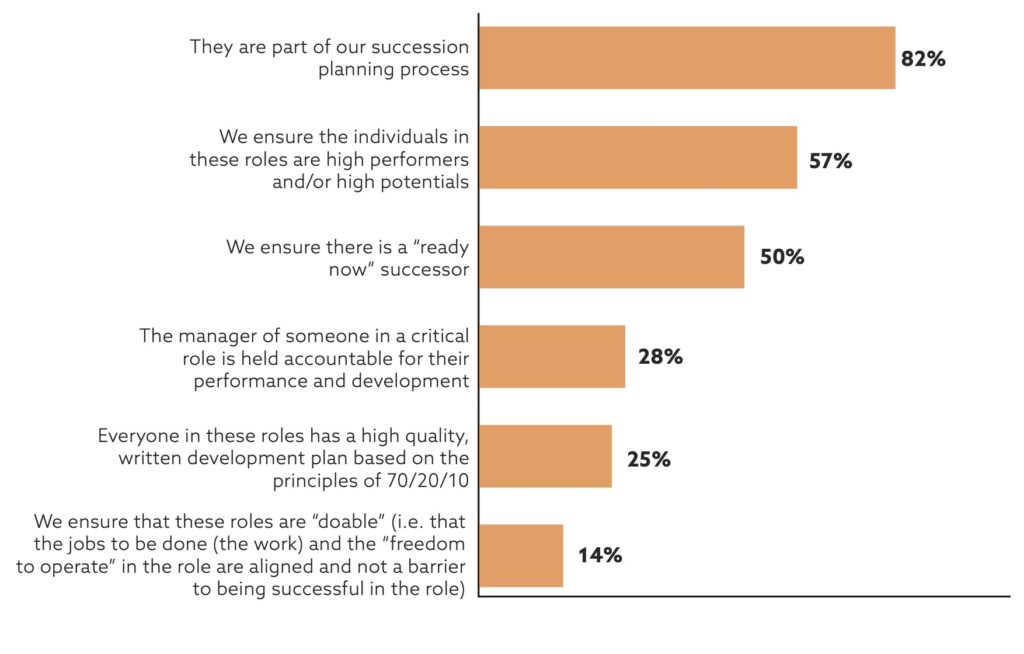

While 82% of companies include critical roles in succession planning, we would expect that based on critical roles often being at higher levels in organizations. Plus, there’s little effort or cost required to include a role in an existing process.

Disappointment quickly follows when practical, logical and obvious follow-up actions don’t occur. A small majority (57%) ensures that individuals in these roles are high performers or high potentials.

Consider that result. You have identified the roles that you say are most critical to your organization’s current and future success. But, nearly half of respondents don’t put the highest quality talent in those roles.

Only half ensure that a successor is ready. Only a quarter of companies hold leaders accountable for critical role development or ensure those in the role have a high quality development plan. And it is perplexing to note that only 14% of companies work to ensure that the incumbents of critical roles are set-up for success in terms of the work to be done and their freedom to operate.

Beyond identifying critical roles, do you identify . . .

Only a small percentage of respondents say their company goes beyond critical roles to other critical elements of work including critical teams, interfaces and behaviors. Our experience suggests that these numbers are inflated, likely from our not defining those terms.

Do you extend your thinking to include?

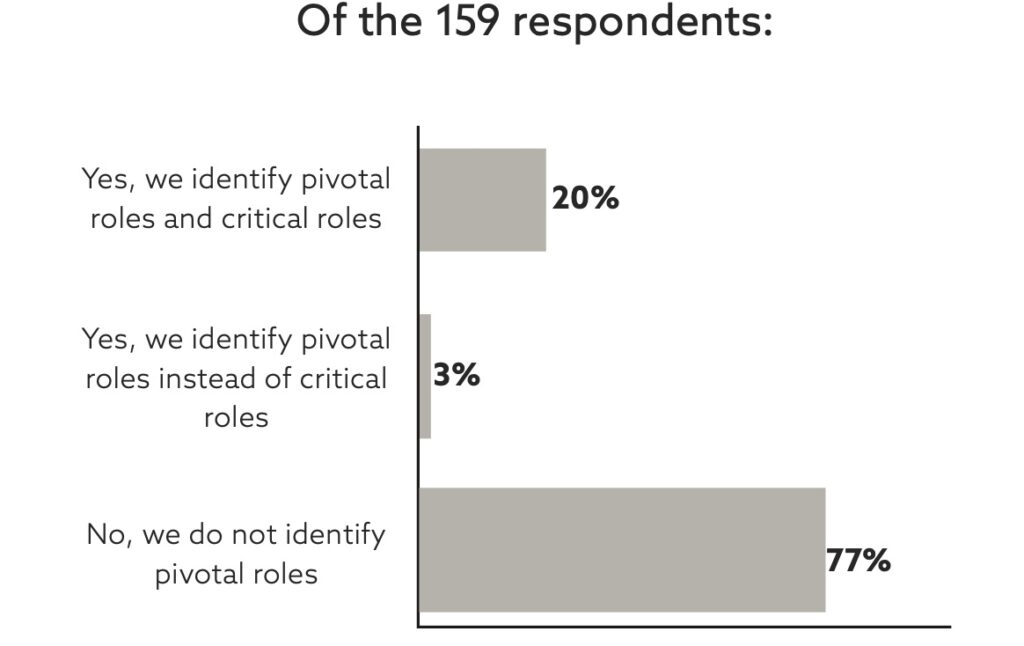

Does your organization select any roles as “pivotal roles”*?

*We defined pivotal role in the survey as: A pivotal role may not be the highest- ranking or most obvious, but something about what they do can drive significant value creation in the business. *For more information, read, Boudreau, John W., and Peter M. Ramstad. Beyond HR: The new science of human capital. Harvard Business Press, 2007.

Survey Respondent Demographics

About the Report, Firm & Authors

Our Report

To create the 2025 Critical Roles Report, we solicited responses through an email to about 20,000 contacts and multiple LinkedIn posts in late 2024.

Participants answered 10 questions and no answers were forced after an initial validation screen to ensure that respondents were HR practitioners. This data gathering method introduces potential response biases. We don’t assume that the collective responses constitute a perfectly representative sample of the HR population. We believe the sample size, combined with the diversity of respondents’ company size and sector, helps to reduce bias that could fundamentally alter any of the report’s findings. All data was gathered without attribution to any individual, so no incentive existed to be other than honest in responding.

The Talent Strategy Group

The Talent Strategy Group helps the world’s premier companies, governments, foundations and non-governmental agencies transform human resources and their ability to grow talent. Our advisory services include HR strategy, organization design, HR leader assessment and HR process design, among others. Our education and development services are based at our Talent Management Institute, which is the world’s most popular executive education program on talent. We teach executives and HR leaders how to build better talent faster through our public and private programs.

We advise across sectors and geographies. We have deep consulting experience in consumer products, big food, technology, pharmaceutical and bio-pharmaceutical companies, medical devices, financial services and health care. We partner with private equity firms to assess and develop talent for C-suite roles.

Authors

Marc Effron is the President of Talent Strategy Group. He advises the world’s premier companies, foundations, governments, NGOs and not-for-profit organizations on their most critical talent issues. He co-authored the Harvard Business Review Publishing best-selling books One Page Talent Management, often referred to as the “talent management bible,” and 8 Steps to High Performance.

Marc co-founded the Talent Management Institute at the University of North Carolina. It has become the world’s most popular executive education program on talent.

Peter Attfield is the APAC Representative of Talent Strategy Group. He is a CHRO level HR thought leader with a proven global track record in strategic Business Partnering and HR Expertise leadership across multiple sectors and geographies. Most recently, he was the Chief Talent & Learning Officer for Jardine Matheson based in Hong Kong from 2018 to 2024.